How often have you seen statements like this?

I have not been investing for a very long time. I certainly have never invested through a recession. During the Global Financial Crisis, I had just graduated from college with thousands of dollars in student loan debt. By the time I finally paid those off in 2017, I thought I missed one of the greatest bull runs in history.

Once my student loans were paid, I was able to focus more on investing over the last few years. As someone whose career is in finance, it can be easy for me to be over-confident in my personal finance decisions. Naturally, I seek out the expertise of smart people. How do they think? How do they act in challenging financial situations? How do they set themselves up to do well financially over the course of their life?

Nick Maggiulli is a data scientist and financial blogger at Of Dollars And Data. He writes about why most traditional financial advice has failed us. Nick helps investors see that investing decisions are never as easy as they seem. He sheds new light on personal financial decisions, using storytelling and data to help his audience understand these situations at a deeper level.

Nick’s philosophy is that each investor experiences life and investing differently. We get married, have kids, lose jobs, get sick, experience loss, change careers, and the list goes on. Our lives are dynamic, and the financial decisions we make are dynamic too. In order to make wise financial decisions, we need to understand our biases, our wants, our strengths and our weaknesses. Once we understand ourselves, we will be better equipped to make smart financial and life decisions.

I found Nick Maggiulli’s work in July 2018 and have been an avid reader ever since. At that time, he had 80 posts on his blog, which I read almost immediately to devour the financial wisdom he shared. Nick has written a blog post every week for 167 weeks in a row, allowing me to learn interesting and insightful data along the way.

If you are interested in reading Nick’s work, here’s where you should start:

Popular posts: https://ofdollarsanddata.com/popular-posts/

Of the 167 posts on his blog, I want to share five that have resonated with me the most:

If you only read a single post to understand the essence of Nick’s blog, this is it. As investors (and humans), we have the tendency to believe we can time the market. We think we have the power to increase our rates of return by using a dollar cost average strategy (DCA) instead of investing in a lump sum manner. Maggiulli includes a fascinating data visualization to show that DCA underperformance increases as the length of the buying period increases.

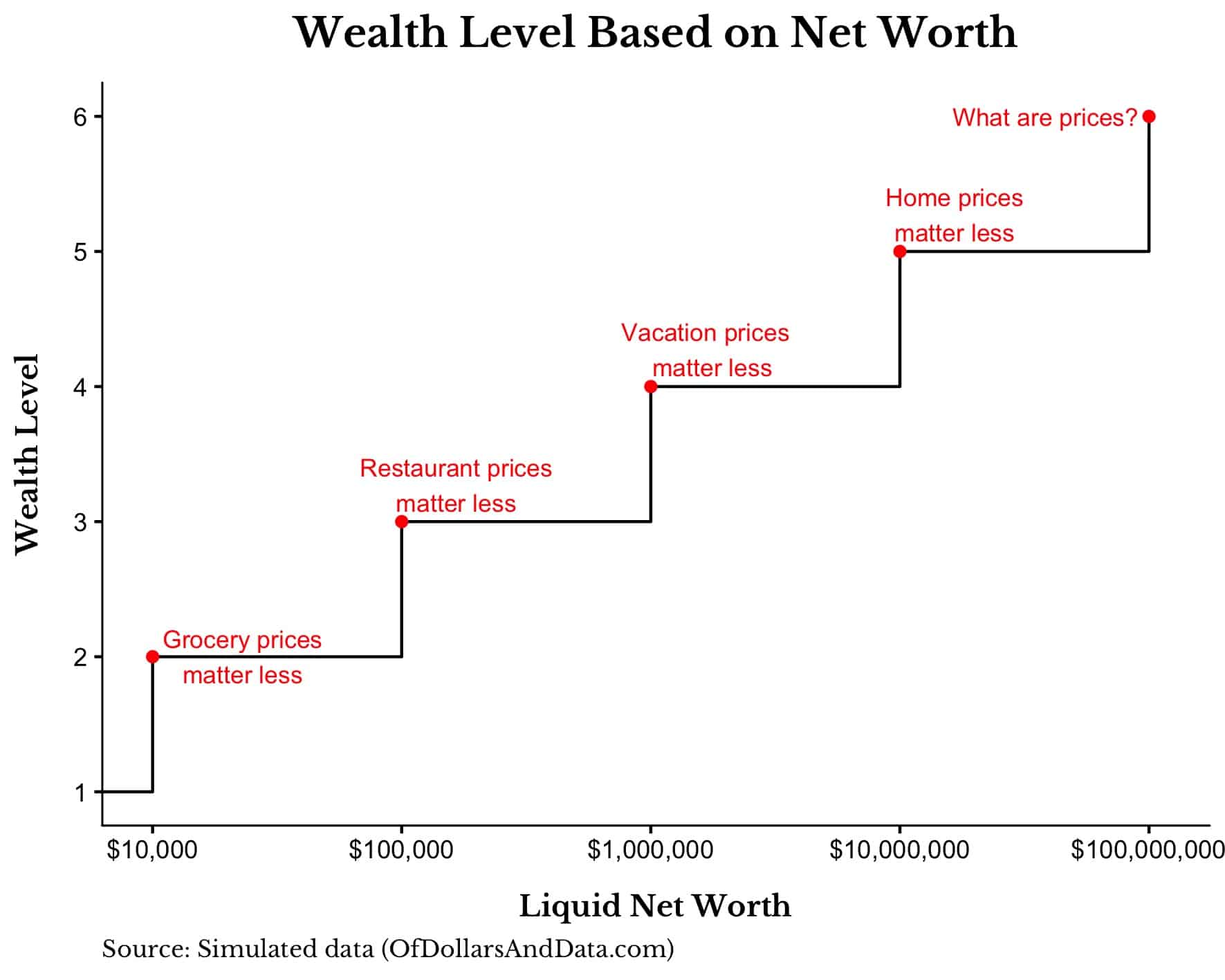

As I begin to build wealth, thinking about where and how I spend and save my money is so important. This post helped me frame financial decisions in the context of “income levels”. A good proxy to use is 0.01% of your net worth. Let’s say you are at the grocery store and you are deciding whether to purchase a dozen regular eggs for $1.99 or a dozen cage-free eggs for $2.99. If your net worth was $1,000, this single choice (paying $1 extra for cage-free eggs) could have a slight impact on your finances as it would represent 0.1% of your total assets. However, if you were worth $10,000 (or more) the decision to spend $1 more would likely be trivial to your finances since it represents less than 0.01% of your wealth.

- Level 1. Paycheck-to-paycheck: $0-$0.99 per decision

- Level 2. Grocery freedom: $1-$9 per decision

- Level 3. Restaurant freedom: $10-$99 per decision

- Level 4. Travel freedom: $100-$999 per decision

- Level 5. House freedom: $1,000-$9,999 per decision

- Level 6. Philanthropic freedom: $10,000+ per decision.

We have a seemingly endless supply of investment advice at our disposal. The truth is the decisions we make today will have compounded effects decades later. In the short run, they are almost invisible. In the long run, however, our decisions can lead to incredible results.

“When you increase your savings rate from 5% to 10%, you don’t get 5% more money at the end, you double the amount of money you have. The first day you form your exercise habit is the day you lose the weight. The first day you form your writing habit is the day you wrote your best work. It all compounds back to the moment when the habit is formed.”

The same is true in writing online, or personal finance. We naturally get intimidated by all the competition out in the world. Investing is the study of human behavior. It’s important to remember that we are only competing against ourselves. Maggiulli’s goal is to get the reader to re-examine their behavior. Michael Jordan said it best:

“Every day, I demand more from myself than anybody else could humanly expect. I’m not competing with somebody else. I’m competing with what I’m capable of.”

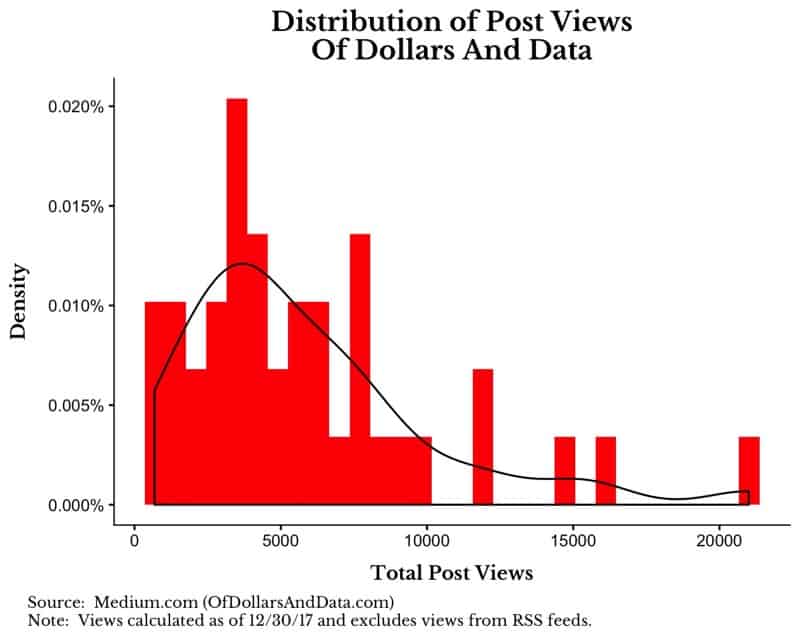

Seven Things I Learned From One Year of Blogging

As with most of the posts on Of Dollars and Data, the ideas can be applied to personal finance, online writing, or life in general. In the context of writing online, this post focuses on the perseverance to continue doing the work – as hard as it may be. Successful people in life share a common trait in anything they do, they don’t give up. Hard work and luck go hand in hand to create successful outcomes. As Samual Goldwyn said:

“The harder I work, the luckier I get.”

This is a non-investing article but still excellent. Nick discusses that we should all be able to step back and understand the depth of privilege in our own lives because some people unfortunately don’t have the same opportunities. Privilege goes beyond growing up with wealth or having more than others. It’s in the color or your skin, the community you grew up in, and so much more.

Nick Maggiulli won’t give you all the answers when it comes to your finances. But that is not the point. He does an incredible job of framing complex financial problems into easy-to-understand, relatable stories backed up by data and facts. At the end of the day, each individual investor is responsible for their decisions. Nick’s writing has helped me frame my own financial goals, and has given me the data to confidently make those decisions.

You can subscribe to Of Dollars And Data here.