Stop asking $3 questions and start asking $30,000 questions.

Every day we wake up, there are a million money-related decisions we can make.

Should I eat out?

Should I buy this new kitchen appliance?

I’m going grocery shopping—should I go to Whole Foods or another store?

By narrowing down a few key beliefs, you can eliminate 99.9% of decision making and focus on more important things.

By doing this, you don’t have to worry about spending at a general level. Why? If the rules you set are followed correctly, they will lead you to the right place.

When you’re suddenly faced with the choice of paying extra for guacamole on your Chipotle bowl, the decision becomes effortless if you’re taking care of more important issues like contributing a higher percentage to your 401k.

That’s the difference between asking $3 questions and $30,000 questions.

My parents sacrificed everything to give me a chance at a better life when they immigrated to three different countries before I was 12. So, everything I learned about personal finance was through the lens of their struggles and experiences.

I believe it’s no accident I pursued a career in finance and became conscious about budgeting and money management. My parents’ experiences instilled a core belief that I should save and invest diligently to set myself up for the future—because they didn’t have that opportunity.

I lived with my parents until I was 26—not because I thought it was great for my social life (it wasn’t), but I understood that paying off my student loans meant I could start saving and investing for my future sooner. I remember the day I sent my final student loan payment. I don’t know what it’s like for people who have millions of dollars in their bank accounts, but I have never felt as rich as the day I was completely debt-free.

Financial literacy is a taboo topic in our society and seldom taught in schools. It’s the responsibility of our elders and wise entrepreneurs to impart that knowledge onto young people in order to prepare them for life. Luckily around the time that started focusing on these decisions, I discovered Ramit Sethi.

Sethi is a personal finance entrepreneur and author of the 2009 New York Times best seller I Will Teach You To Be Rich. His approach to finance is to recognize that money should not rule our lives but instead be a tool to help us reach our long-term goals. His ideas have helped many young adults (including myself) figure out their finances and set up systems and rules for their money.

His goal is to make personal finance exciting and rewarding, a contrast from the pretentious, dry, guilt-inducing rhetoric we associate with the personal finance space. Sethi stresses the importance of finding what you enjoy and spending lots of money on it.

“Spend extravagantly on the things you love, and cut costs mercilessly on the things you don’t.”

Sethi recently shared his personal Money Rules. He says that everyone should develop a point of view for the important things in life such as: money, relationships, health, parenting.

Part of creating your money rules is making them creative for YOU. Rules generally sound bad or restrictive, but developing personal money rules can be fun and interactive. Reframing the idea of having rules can be empowering and freeing, especially when they are so personal.

Money rules should be tailored to you and your values, they are not meant to be cookie-cutter decisions. In this post, I want to summarize Sethi’s Money Rules. In a follow-up, I will share my own list. Like the 12 Favorite Problems exercise, having rules about money is a great forcing function to focus on what really matters and where our priorities lie.

Rules can be about people, not just money. After all, what’s money for? At a certain point, after you’ve covered the basics—you should use money for the people and things you love.

Ramit Sethi’s Money Rules and Explanations:

- Always have one year of emergency fund available in cash:

Sethi explains that he’s more conservative than most. He wants to make sure that he sets himself up so that if something catastrophic happens (like a global pandemic), he doesn’t have to worry about his finances. Traditionally, Sethi recommended that people have 3-6 months saved, but recently changed it to one year. For most people, having a one year emergency fund is overwhelming. First, it’s a lot of money and there’s a trade-off where money stays in cash instead of being invested. You should try to keep the money in a high-yield savings account. The key is planning for the best and worst scenarios so that if something happens, you can buy yourself some time if you have to look for a job.

How to implement Rule #1:

- Create a detailed personal budget that tracks your income and expenses.

- Calculate your monthly fixed (rent, utilities) and variable (food & dining, shopping) expenses to know exactly how much you need in an emergency fund. If one year is too overwhelming, try to save 3 months.

- If you have money left over each month, transfer it to a high-yield savings account like Goldman Sachs’ Marcus.

- Save 10% and invest 20% of gross income, minimum:

Sethi says that saving 10% of gross income can be used for things that come up in the future such as: emergency fund, vacation, down payment on a house. Investing 20%, especially when you’re young means every dollar will be worth many times more in the future. The real money is generated from investments, not savings. Choosing to prioritize these values on gross income instead of net income is like living life on ‘hard mode’. If you prioritize saving 10% and investing 20%, you’re doing great on the income and growth side and can worry less about smaller aspects of your financial decisions. This is the kind of rule where if you just follow it on its own, you’re ahead of the game financially.

How to implement Rule #2:

- Calculate your annual gross salary and allocate 10% to a high-yield savings account, and 20% to investments.

- I calculated how much I need to save annually and have an automatic transaction from my checking to my savings account each week. Moving smaller increments makes me not notice that it’s missing from my spending account.

- Pay cash for large expenses. 20% down, minimum, on a house:

Paying cash for large expenses doesn’t mean handing over a stack of $100 bills for large purchases. You can still buy expensive things with a credit card to accrue rewards and take advantage of financial protection, it just means not going into debt to pay for the item. It’s having the cash available in savings to pay for things in full. For a house, 20% down payment minimum (if not more). If you go to buy a house and you’re not ready to put 20% down, you’re not ready to buy a house. There are lots of large expenses in life, and we should be able to plan ahead 5-10 years and estimate what those will be. If you’re planning on buying a $60,000 car in 5 years, you can plan to save $1,000 per month in a sub-savings account. The longer your time horizon, the less you have to save each month to hit your goal.

How to implement Rule #3:

- Assign every dollar in your budget a job. My budget includes a line item that allocates money to my savings account. I consider this an expense in my budget since I’m paying—myself.

- When I was planning to propose to my now fiancée, I calculated my budget for a ring and allocated an appropriate amount into my savings account each month to completely cover the cost when it was time to make the purchase.

- Never question spending money on books, appetizers, health, or donating to a friend’s charity fundraiser.

When Sethi was in college at Stanford, he received a very generous scholarship that covered the cost of any book he wanted completely for five years. When he left school, he wanted to continue the freedom of unlimited books. In the grand scheme of life, the cost of books is not that expensive. He made a policy for himself called “Ramit’s book-buying rule”, whenever he finds a book that’s interesting, he buys it immediately without hesitation.

When Sethi was younger, his family rarely ordered appetizers in restaurants. He says it’s extremely freeing now to be in a restaurant and when faced with a decision which appetizer to order, to just get both. The amount he spends is small relative to the joy he or his family/co-workers experience when they can order whatever looks interesting on the menu.

How to implement Rule #4:

- I have a fun implementation of this rule. When my friends started getting married, I made a rule that I would give them a very nice chef’s knife as a gift. I love cooking and it’s something we have to do almost every day. With a good knife, prep becomes easier and the recipient of the gift will always think of you.

- Business class on flights over 4 hours.

This one is simple, it’s something that Sethi wanted. In his early 20s, he scoffed at anyone who he thought was wasting money on business class travel. He realized over the years that Business class is nice, and because he could afford it and comfort was important, he made it a rule. The decision-making process becomes even easier when the constraint of time is included. When a flight is longer than 4 hours, his assistant books a flight in Business class—no questions asked. But, if a flight is short, he doesn’t mind sitting in a coach seat. Part of having these rules is not going from 0-60, but finding what is important and valuable to you.

How to implement Rule #5:

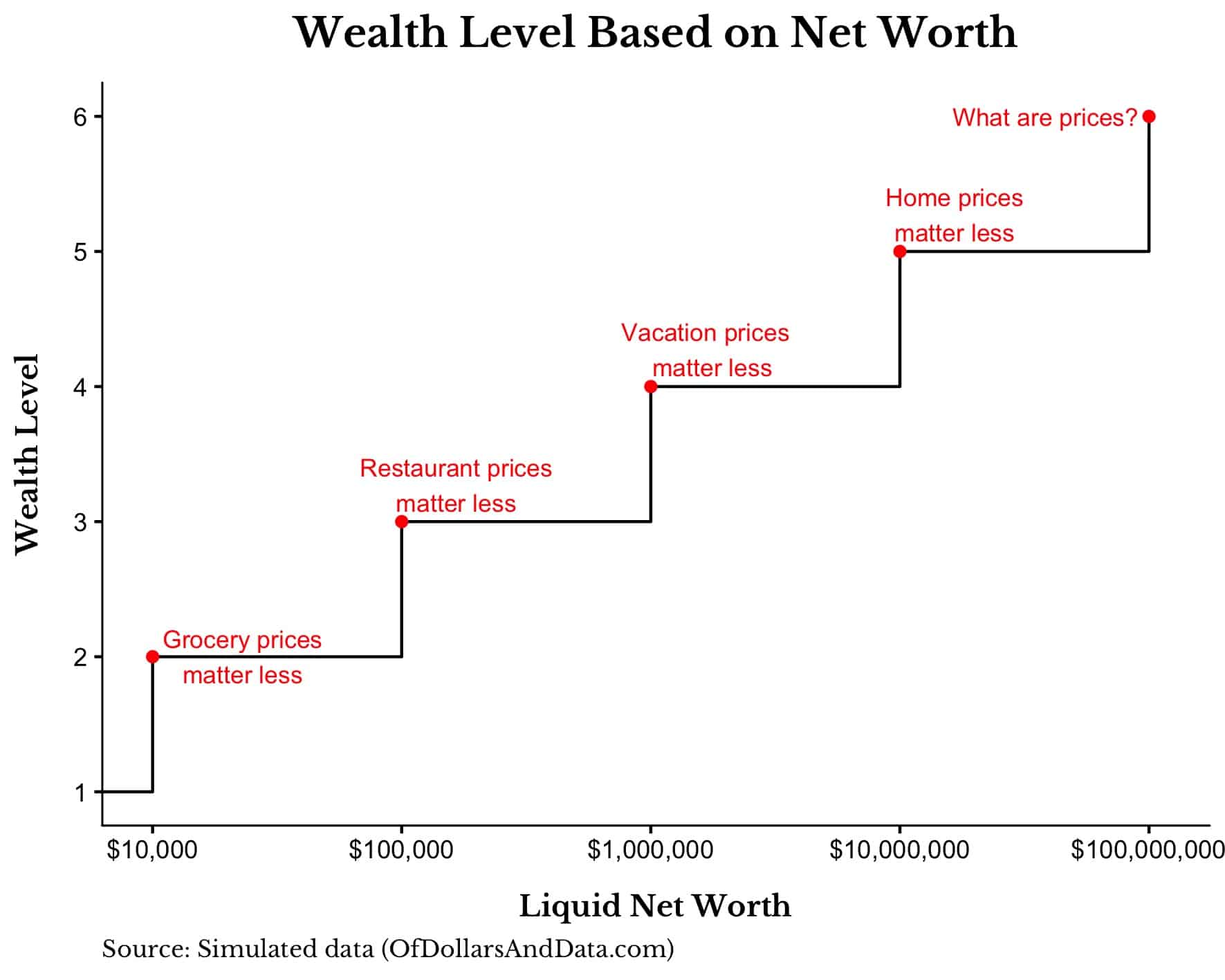

- Nick Maggiulli wrote an excellent post on this topic called Climbing the Wealth Ladder. He framed making financial decisions based on your net worth. If a purchase decision is 0.01% of your net worth, it’s trivial and you shouldn’t spend too much time thinking about it. As you move up in levels of wealth, $1 decisions, $10 decisions, $100 decisions eventually become trivial.

- No limit on spending for health (personal trainer) or education (courses, events, etc.)

There are some things in life that you just don’t look at the price tag for. Sethi says that if he sees a course or event that sounds interesting, he’s in—regardless of cost. He emphasizes that everyone should have this rule on something in their life where prices are irrelevant. If you like a certain type of organic food (ex. strawberries), you can find something that’s half the price but you will always buy the one you think is better even if it’s more expensive.

All of us have something that is valuable and meaningful to us. For Sethi, this just happens to be health and education. When it came time to look for a personal trainer, he didn’t want to watch YouTube videos, he wanted to find someone who would give him faster results and he didn’t have to spend extra time thinking about it. These things are important to him, so he uses his money as a tool to help him live a “richer” life.

How to implement Rule #6:

- To a certain extent, we all have things we buy where the price tag doesn’t matter. If you’re doing well on saving and investing with money left over, you shouldn’t have to stress about buying something that makes you happy.

- I value experiences over material possessions, so I will always default to spending more when I’m on vacation or out with friends.

- Buy the best and keep it for as long as possible.– Everything Cheap comes out expensive.

Sethi grew up in a frugal home. There were six members in his family, his dad worked and his mom took care of the family at home. His uncle was a photographer who had a Leica camera. Leicas are some of the best cameras in the world, they are like a functional piece of art. His uncle gave that camera to his dad in the 70’s and the camera still works—in fact, it was the camera that Sethi learned to take photos on.

He started to see what it’s like to have something that’s the best and keep it forever. That camera has been in his family for generations and it will continue to be. Best can also be synonymous with reliable. For the things that you use day-to-day, like your phone—get the best, but then keep it! Sometimes people buy the best but flip it frequently. If you buy the best and amortize the cost over a long period of time (10+ years), the cost is often more affordable than buying cheaper and changing every year. With clothing, buying the best means materials will last and you will have peace of mind that things won’t wear and tear easily. Plus, if something does break, tear or rip, buying the best often means that it will get taken care of free of charge.

How to implement Rule #7:

- It can cause some initial sticker shock, but buying quality products that last can be a game-changer for your overall wealth. If you don’t have to replace what you buy frequently, you can be free to save and invest more money. I bought some All-Clad pots and pans recently that I hope will be with me for decades.

- There’s a Subreddit dedicated to these items called /r/BuyItForLife

- The inverse is also true—I have 10-15 cheap T-shirts from Uniqlo and know they won’t last forever. That’s perfectly okay too.

- Earn enough to work only with people I respect and like.

This is a rule that only tangentially touches money. Sethi says that when he wakes up in the morning and looks at his calendar, he doesn’t want to work with someone who makes him look at the invite and say, “ugh! I have to meet with this person today”. He says that he has fired senior people at this company who have not been nice to other co-workers. He made it a priority to work with people that he respects, loves, and trusts once he earned enough money. Money gives him the ability to use it in such a way that he can work with people he enjoys being around.

How to implement Rule #8:

- This is another rule very specific to Sethi. Most people are not in the position that he’s in, we don’t have the benefit to make hiring decisions and choose who we work with.

- Marry the right person.

This is frequently the most confusing money rule for people. What does marrying the right person have to do with money? The decision on who you marry is one of the most important financial decisions you will ever make. Is your partner aligned with your values? Do they think about saving and spending in generally the same ways that you do? Have you saved up 30% of your income while they have $75,000 in credit card debt? If so, you have a huge problem. Do they get nervous or scared about spending money? Are they abundant or scarcity-minded? You’re going to be thinking about these things every day for the rest of your life.

Money is an integral part of a relationship. If you have different money values from your partner, you’re going to have problems. Marrying the right person means having the same values on simple things like what kind of bread you buy (spending extra on organic), or complex decisions like sending kids to public or private school. What hotel are you going to stay in? How often are you going on vacation and are you bringing your families? These are big questions that will haunt you if you don’t think about them properly together or they’re going to provide you joy if you find a partner who thinks about them similarly to you.

How to implement Rule #9:

- The thinking behind finances for couples is extremely outdated. It used to be that men controlled the finances and women got allowances. The premise of most of I Love Lucy was Lucy spending her allowance one way or another.

- Communication and respect for your partner go a long way to getting on the same page about your finances. This is both for married couples and especially those who are thinking about getting married.

- Prioritize time outside the spreadsheet.

At a certain point, your money will work according to the systems you set up. Everything is good. You’ve won the game, and now it’s time to live life outside of the spreadsheet. This means prioritizing family, loved ones, and health—not sitting and looking at Excel every day. A “rich life” is lived outside of the spreadsheet. There are so many more interesting things in life after you get the 85% solution implemented with savings and investments. Tweaking assumptions is not going to improve your life, but picking up a fun hobby will.

As people think about developing their own money rules, they should actually be confusing to others as you dial in at what is special to you. Rules are individually built like a custom-tailored suit, they should be set up in a way that is made only for you.

If someone says, “appetizers, what’s that about??”, Sethi smiles because he knows that rule is his. That’s what a truly cohesive set of money rules will feel like.

The next post will be a summary of my own Money Rules and explanations.

If you would like to receive future articles by email, subscribe to my Wednesday Wisdom newsletter.